In today’s globalized world, transferring money across borders has become a common need for many individuals and businesses. Certainly! Here’s the revised text with added transition words:

When it comes to navigating international money transfers, you often encounter an unwelcome surprise – hidden fees embedded within exchange rates. Whether you’re sending funds to family abroad, paying a freelancer in another country, or managing business payments across multiple currencies, you might be surprised to find that the total cost is much higher than expected. Why is this the case? Well, traditional banks often mark up exchange rates and disguise these costs, making international transfers more expensive than they should be.

But don’t worry – Wise is here to solve this problem. Built on the principle of transparency and fairness, it strips away the hidden fees and confusion of traditional money transfers. With Wise, you always know exactly what you’re paying and how much your recipient will receive, giving you more control over your money. Whether you’re an expat, digital nomad, freelancer, or business owner, Wise offers an array of innovative products designed to help you save money and manage multiple currencies with ease.

Let’s dive into what makes Wise the perfect solution for transparent, low-cost, and fast international transfers.

The Hidden Problem: Exchange Rate Markups and Steep Fees

Table of Contents

The issue with traditional international transfers lies in the exchange rates used by banks. When you send money abroad, banks often apply a markup on the exchange rate without disclosing it to you. This markup inflates the cost of your transaction, making it significantly more expensive. Add on additional bank fees, and your seemingly simple transfer becomes a pricey endeavor.

But Wise isn’t just about saving you money – it’s about making the entire process faster, safer, and more convenient.

With Wise, international money transfers are up to 8 times cheaper than traditional banks, thanks to their transparent, low-cost fee structure. It operates with the mid-market exchange rate – the real rate you see on Google or XE.com – without any hidden markups. That means what you see is what you get. Wise only charges a small, upfront fee for the service, so you always know the true cost before making a transfer. The result? More money in your pocket and less lost in unnecessary bank fees.

But Wise isn’t just about saving you money – it’s about making the entire process faster, safer, and more convenient.

Why Choose Wise? Key Features That Set It Apart

1. Price: Unbeatable Cost Savings

Using Wise is a breath of fresh air when it comes to cost savings. Unlike traditional banks, which pad their profits with high exchange rate markups, Wise uses the mid-market rate – the fairest rate – without hidden fees. Whether you’re sending money abroad, receiving international payments, or spending in multiple currencies, Wise ensures that your hard-earned money goes further.

Customers can save significantly, especially on large international transfers where the fee difference between banks and Wise becomes even more pronounced. For example, businesses sending payments to suppliers or employees abroad can save hundreds – if not thousands – in fees by choosing Wise.

2. Safety: Regulated and Secure Like a Bank

Concerned about the safety of your funds? You can rest easy with Wise. It is fully regulated and authorized by financial authorities in every country where it operates, meaning your money is protected under stringent guidelines. Wise ensures a high level of security, similar to that of traditional banks, so your funds are always safe during transfers.

With millions of users and billions of dollars transferred globally, Wise has earned a reputation for reliability and security. It’s trusted by individuals and businesses alike for secure, efficient international transactions.

3. Speed: Transfers That Keep Up with Your Life

When time is of the essence, Wise delivers. The service prides itself on its lightning-fast transfers. In fact, 55% of Wise transfers arrive instantly, and 93% are completed within 24 hours. This speed makes Wise ideal for those who need to send money quickly, whether it’s for a personal emergency, paying suppliers, or meeting business deadlines.

Gone are the days of waiting days or even weeks for an international bank transfer to clear. With Wise, your money arrives swiftly, giving you peace of mind and allowing you to focus on more important things.

Gone are the days of waiting days or even weeks for an international bank transfer to clear. With Wise, your money arrives swiftly, giving you peace of mind and allowing you to focus on more important things.

Wise goes beyond just transfers – it’s a one-stop-shop for global currency management. With the Wise account, you can hold, spend, and send money in over 40 currencies, making it easy to manage international finances no matter where you are in the world. This feature is particularly useful for freelancers, digital nomads, or businesses that operate across borders.

Need to send euros to a supplier in Spain? Or perhaps pay for accommodation in Japanese yen? Wise has you covered, offering seamless currency conversions at the real exchange rate, all from the palm of your hand.

Products and Services: Tailored for Every Need

Wise offers a range of products tailored to meet the wide-ranging needs of our users. Let’s take a look at how each product can benefit you:

| Product | Description | Call to Action |

|---|---|---|

| Wise Account | A multi-currency account that allows you to hold, send, and spend in over 40 currencies. Perfect for living abroad, traveling frequently, or freelancing with international clients. | Open a Wise account now |

| Wise Debit Card | Spend like a local in any currency with the Wise debit card, linked to your Wise account. Ideal for online shopping, in-store purchases, and ATM withdrawals in multiple currencies without hidden fees. | Get your Wise debit card |

| Wise Travel Card | Load up multiple currencies before your trip and spend abroad at the best rates. Designed for frequent travelers who want to avoid conversion fees. | Learn more about Wise travel card |

| Wise Business Account | The ultimate tool for global companies. Manage suppliers, send invoices, and handle payroll in multiple currencies while saving on fees. | Discover Wise Business |

| Wise Large Transfers | Save on large international transfers with Wise’s discounted rates for high-value transfers, perfect for sending large amounts without excessive fees. | Start a large transfer |

| Wise Interest | Earn interest on your USD balance with Wise’s new feature, available in the UK, EU, and US. Note that capital is at risk. | Find out more about Wise Interest |

| Wise Interest for Business | Businesses can also earn interest on their balance, helping your money grow while managing it globally, just like Wise’s personal account interest. | Learn more about Wise Interest for Business |

Who Should Use Wise?

Wise’s array of products caters to a wide range of users, from individuals sending money to family abroad to businesses managing cross-border payments. Here’s who can benefit the most from Wise:

- Freelancers and Digital Nomads: Manage payments in multiple currencies seamlessly.

- Travelers: Spend money abroad without the stress of hidden fees or poor exchange rates.

- Businesses: Pay suppliers, employees, or contractors in foreign currencies while saving on large transfers.

- Expats: Hold and transfer money across borders while keeping costs low.

Step-by-Step Guide: How to Open a Wise Account

Ready to simplify your global money transfers? Opening a Wise account is quick, easy, and gets you set up to send, receive, and hold money in over 40 currencies. Let’s walk you through the process step by step.

Step 1: Visit Wise.com

You can start by visiting the Wise website. Whether you’re on a desktop, tablet, or phone, the sleek interface makes it easy to start.

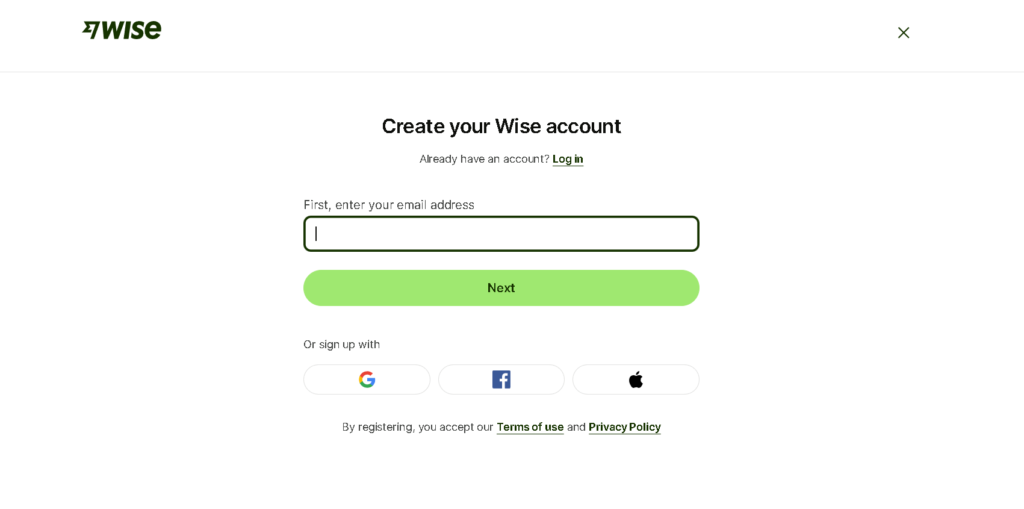

Step 2: Sign Up

Sign up by entering your email, or if you prefer, use your Google or Facebook account for an even faster registration. Check your email [or any service providers you are comfortable with] and confirm your email address. Wise ensures your personal details are securely handled, so you can feel confident in your choice.

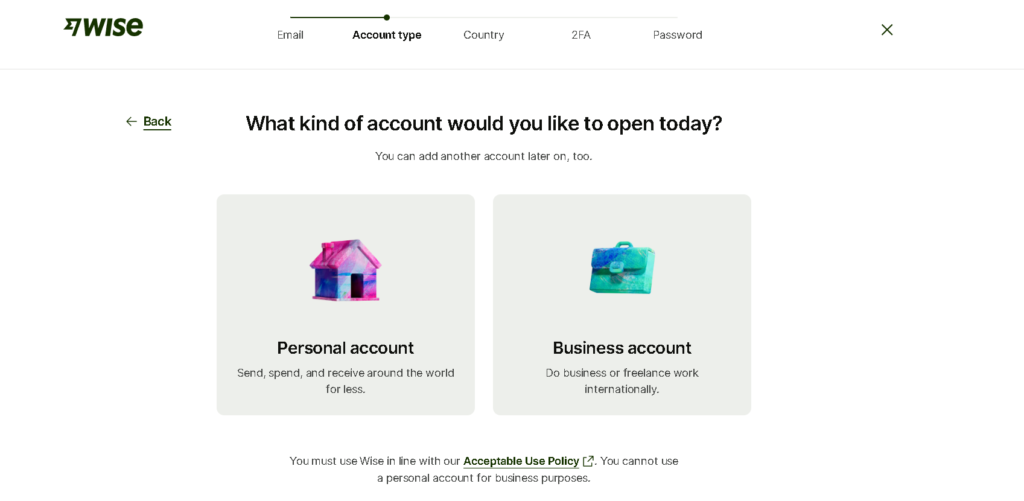

Step 3: Choose Your Account Type: Personal or Business

Next, select the type of account you need. A Personal Account is perfect for individuals managing personal finances, while a Business Account is ideal for freelancers, startups, or established companies.

Step 4: Verify Your Identity

To ensure the security of your transactions, Wise requires a quick identity verification process. Upload your identification documents such as a passport or driver’s license, and sometimes, proof of address. This step helps Wise comply with international financial regulations, keeping your account safe.

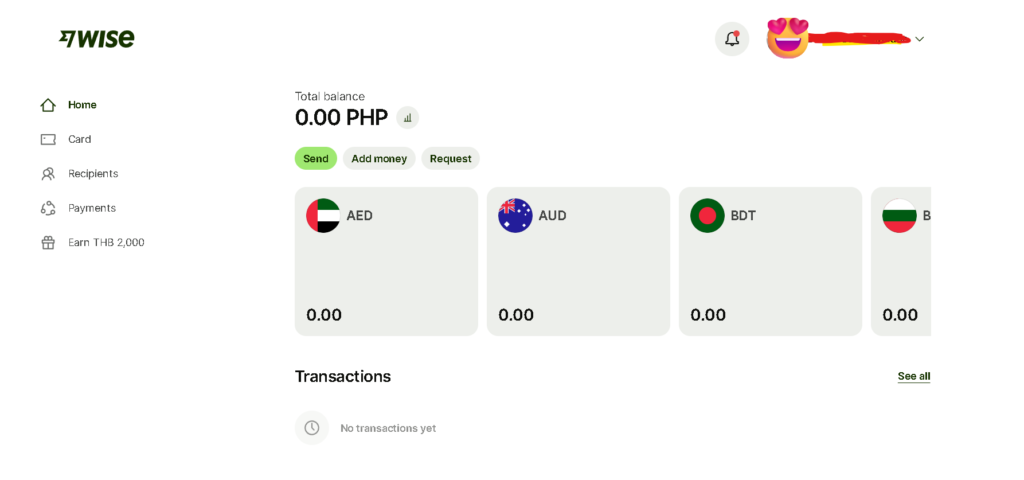

Step 5: Set Up and Start Using Your Wise Account

Once your verification is complete, you’re all set! Your Wise account allows you to hold balances in multiple currencies, send money internationally with minimal fees, and even receive payments like a local.

Now that you’re all set up, you can start enjoying the benefits of low-cost international transfers, holding balances in different currencies, and paying like a local wherever you go. Ready to get started? Open a Wise account now!

By following these easy steps, you can quickly open your Wise account and unlock seamless international money management at your fingertips!

Additional Tips:

- For business users, Wise offers additional tools like invoicing and bulk payments.

- Download the Wise app for even faster management of your money on the go!

How Wise Helps You Save More?

Want to know exactly how much you can save? Wise offers an easy-to-use calculator widget that compares their fees to other services. You can also use their price comparison tool to see how much you’ll save on large transfers.

If you’re tired of hidden fees, poor exchange rates, and slow transfers, Wise offers a smarter, more transparent solution. With low upfront fees, fast transaction times, and the ability to hold over 40 currencies, it ensures you keep more of your money where it belongs – in your wallet. Whether you’re an individual making international payments or a business managing global finances, Wise is a clear choice for anyone looking to cut costs and streamline their money management.

If you’re tired of hidden fees, poor exchange rates, and slow transfers, Wise offers a smarter, more transparent solution. With low upfront fees, fast transaction times, and the ability to hold over 40 currencies, Wise ensures you keep more of your money where it belongs – in your wallet. Whether you’re an individual making international payments or a business managing global finances, Wise is a clear choice for anyone looking to cut costs and streamline their money management.

Ready to take control of your money?

Affiliate Disclaimer:

In the spirit of transparency, please be aware that this article may contain affiliate links. This means that if you click on such a link and make a purchase, I may earn a commission at no additional cost to you. I genuinely believe in the products and services mentioned, and the inclusion of affiliate links is merely a way to support the efforts and maintenance of this platform. Your support is truly appreciated and enables us to continue delivering valuable content. Rest assured, my recommendations are based on thorough research and a sincere desire to assist you in your affiliate marketing journey.

Leave a Reply